Bill .com is a leading online platform that helps businesses simplify their accounts payable and accounts receivable processes. Designed for small to medium-sized businesses, Bill .com automates invoicing, bill payments, and cash flow management, saving time and reducing errors. With features like electronic payments, invoice management, and seamless integration with accounting software, Bill .com has become a trusted solution for business owners and finance teams. This article explores the features, benefits, content categories, and practical uses of Bill .com, demonstrating why it is a critical tool for efficient financial management.

What Is Bill .com?

Bill .com is a cloud-based financial management platform designed to streamline business payments and invoicing. By automating key processes, it allows companies to manage accounts payable and accounts receivable more efficiently, reducing manual work and human error.

A Hub for Business Finance Automation

Bill .com is suitable for businesses of all sizes looking to simplify their financial processes, save time, and enhance cash flow visibility.

Focused on Efficiency and Accuracy

The platform emphasizes automation, secure electronic payments, and real-time financial insights, making business operations smoother and more reliable.

Core Features of Bill .com

Accounts Payable Automation

Businesses can automate bill approval workflows, schedule payments, and send electronic payments directly to vendors, reducing manual effort and late fees.

Accounts Receivable Automation

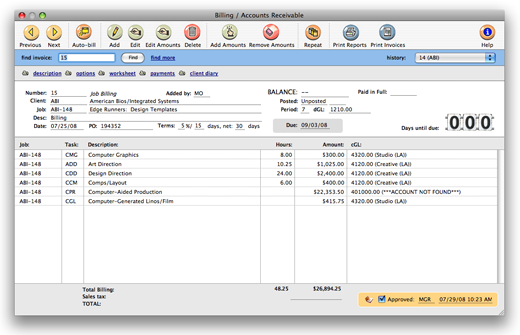

Invoice creation, sending, and tracking are automated, ensuring faster payments and better management of outstanding balances.

Invoice Management

Bill .com provides tools for creating, storing, and managing invoices, enabling businesses to maintain accurate records and streamline reporting.

Cash Flow Visibility

Real-time dashboards give businesses insights into cash flow, upcoming payments, and outstanding invoices, helping with better financial planning.

Integration with Accounting Software

Bill .com integrates seamlessly with popular accounting platforms like QuickBooks, Xero, and NetSuite, reducing duplicate data entry and errors.

Content Categories on Bill .com

Accounts Payable Solutions

Tools to manage vendor payments, approval workflows, and electronic bill payments.

Accounts Receivable Solutions

Features for invoicing, tracking payments, sending reminders, and improving collections.

Financial Management Insights

Reports and dashboards provide detailed insights into cash flow, unpaid bills, and financial health.

Automation Tools

Workflow automation, recurring payments, and electronic approval systems simplify financial processes.

Integration Options

Seamless connection with accounting software, banking platforms, and payment gateways for streamlined operations.

Why Bill .com Is Popular

Time-Saving Automation

Automated workflows for bills and invoices reduce manual effort and free up time for strategic work.

Error Reduction and Accuracy

Electronic payments and automated tracking minimize human errors, duplicate entries, and late payments.

Improved Cash Flow Management

Real-time insights and dashboards help businesses anticipate cash needs and manage finances effectively.

User-Friendly Platform

Intuitive design makes it easy for finance teams to navigate, approve payments, and generate reports efficiently.

Scalable Solution

Suitable for small businesses, growing enterprises, and large organizations, allowing financial processes to scale with business needs.

Benefits of Using Bill .com

Streamlined Financial Processes

Automation ensures bills and invoices are handled efficiently, reducing administrative burden.

Faster Payments and Collections

Electronic payment features improve payment speed, enhancing vendor relationships and revenue collection.

Reduced Operational Costs

Minimized paper usage, lower administrative overhead, and fewer late fees reduce overall costs.

Enhanced Security and Compliance

Secure payment processing, audit trails, and compliance with financial regulations protect business operations.

Data-Driven Insights

Detailed reports and analytics provide actionable insights for financial decision-making and planning.

How to Use Bill .com Effectively

Automate Your Accounts Payable

Set up automated approval workflows and schedule payments to avoid late fees and improve efficiency.

Streamline Accounts Receivable

Send automated invoices, reminders, and payment confirmations to accelerate collections.

Leverage Dashboard Insights

Monitor cash flow, track unpaid invoices, and plan payments strategically using real-time dashboards.

Integrate With Accounting Software

Connect Bill .com with QuickBooks, Xero, or other accounting tools to sync financial data and reduce manual work.

Use Security and Compliance Features

Enable secure electronic payments, maintain audit trails, and adhere to compliance regulations for financial operations.

Who Should Use Bill .com?

Small and Medium-Sized Businesses

Companies looking to automate payments, reduce manual work, and manage cash flow efficiently benefit the most.

Accounting and Finance Teams

Teams seeking streamlined workflows, accurate reporting, and improved vendor and client relationships will find Bill .com invaluable.

Entrepreneurs and Startups

New business owners can manage finances without hiring large accounting teams, using automation to reduce operational overhead.

Large Enterprises

Bill .com scales for large organizations, integrating with multiple departments, software platforms, and vendors efficiently.

Unique Features That Set Bill .com Apart

All-in-One Financial Automation

It combines accounts payable, accounts receivable, cash flow management, and reporting in a single platform.

Integration and Compatibility

Seamless connectivity with accounting software and banking platforms reduces duplicate entry and ensures accurate data.

User-Friendly Interface

Designed for intuitive navigation, Bill .com allows finance teams to approve payments, track invoices, and generate reports easily.

Actionable Financial Insights

Dashboards, reports, and analytics provide actionable insights to support strategic business decisions.

Secure and Compliant

Secure payment systems, encryption, and audit-ready features protect sensitive financial data.

Future of Bill .com

Expanded Automation Features

Plans include more intelligent automation, AI-driven financial insights, and enhanced workflow management tools.

Enhanced Reporting and Analytics

Advanced dashboards and predictive analytics will allow businesses to forecast cash flow and manage finances proactively.

Global Expansion

Bill .com aims to provide international payment processing, multi-currency support, and global vendor management.

Community and Learning Resources

Future updates may include tutorials, webinars, and knowledge-sharing resources for finance professionals.

Conclusion

Bill .com is a comprehensive, secure, and efficient platform for managing business finances. With automation for accounts payable and receivable, cash flow visibility, seamless integration with accounting software, and expert insights, it helps businesses save time, reduce errors, and improve financial decision-making. Whether you are a small business owner, entrepreneur, finance professional, or part of a large enterprise, Bill .com provides the tools, guidance, and automation necessary to streamline operations and optimize cash flow effectively.

Add a Comment